Cyber insurance entering a new phase of development as non-US territories set to capture 54% of growth up to 2030, according to new Howden report

Published

Read time

- With no sign of the threat environment relenting, strong competition and pricing reductions of 15% from 2022 peak offer buyers an opportunity to secure protection at favourable terms

- Stable market conditions, supported by robust risk controls amongst insureds, provide the foundations for exposure-led growth, ongoing profitability and innovation

- Growth set to be driven by international markets and small and medium-sized enterprises

London, 1 July 2024 – Howden, the global insurance intermediary group, today releases its fourth annual cyber report, titled Risk, Resilience and Relevance. Following a major market correction off the back of surging ransomware claims in 2020 and 2021, conditions started to stabilise last year as improved cyber hygiene amongst insureds helped to prevent or mitigate the impact of attacks.

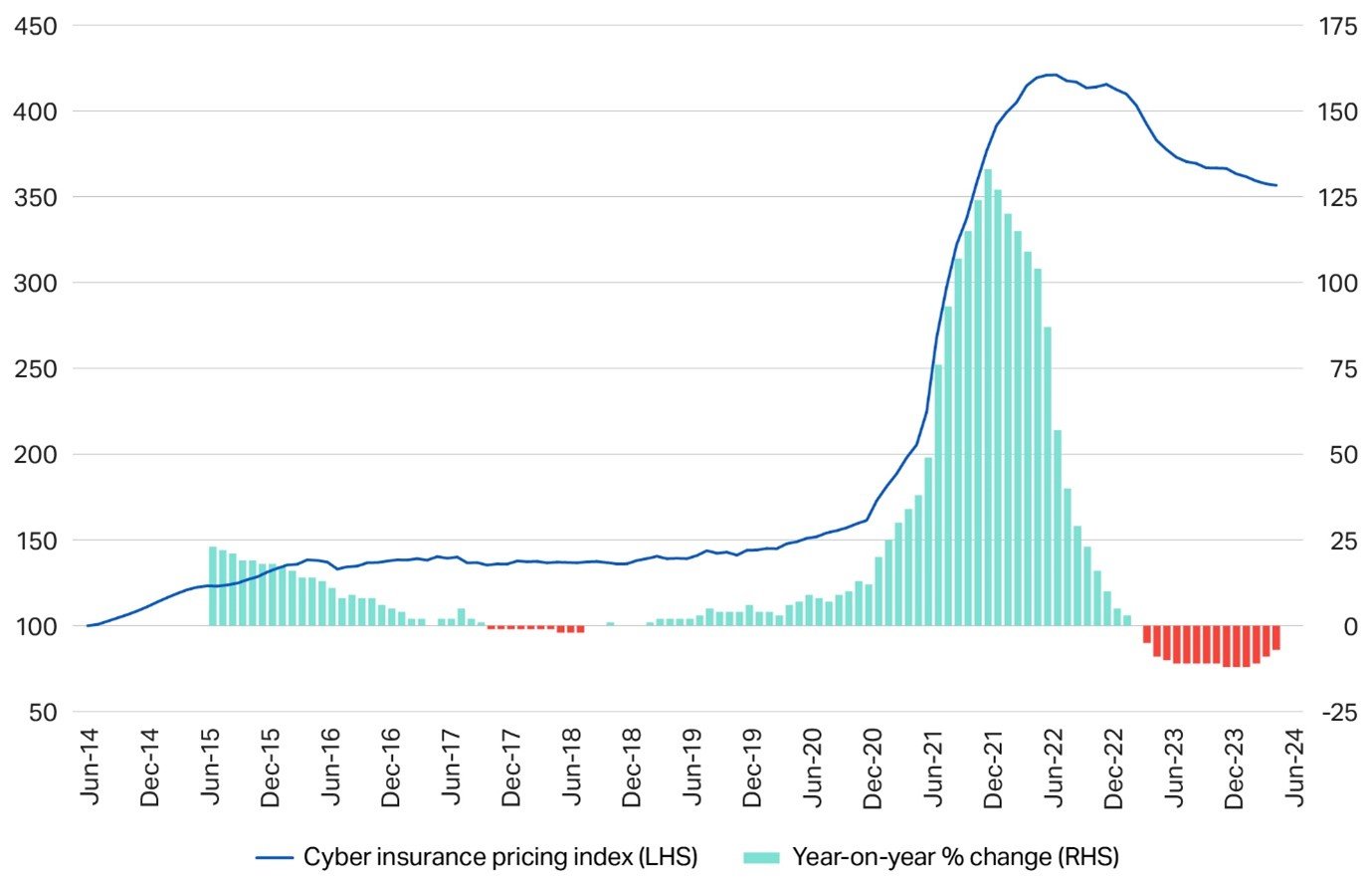

Sarah Neild, Head of Cyber Retail, UK, Howden, said: “Favourable dynamics have persisted into 2024, with the cost of cyber insurance continuing to fall (as shown by our global pricing index in Figure 1) despite ongoing attacks, heightened geopolitical instability and the proliferation of Gen AI. At no other point has the market experienced the current mix of conditions: a heightened threat landscape combined with a stable insurance market underpinned by robust risk controls. The foundations for a mature cyber market, with innovation and exposure-led growth at its core, are now in place.”

Figure 1: Howden’s Global Cyber Insurance Pricing Index – 2014 to 2Q24 (Source: Howden)

Relevance

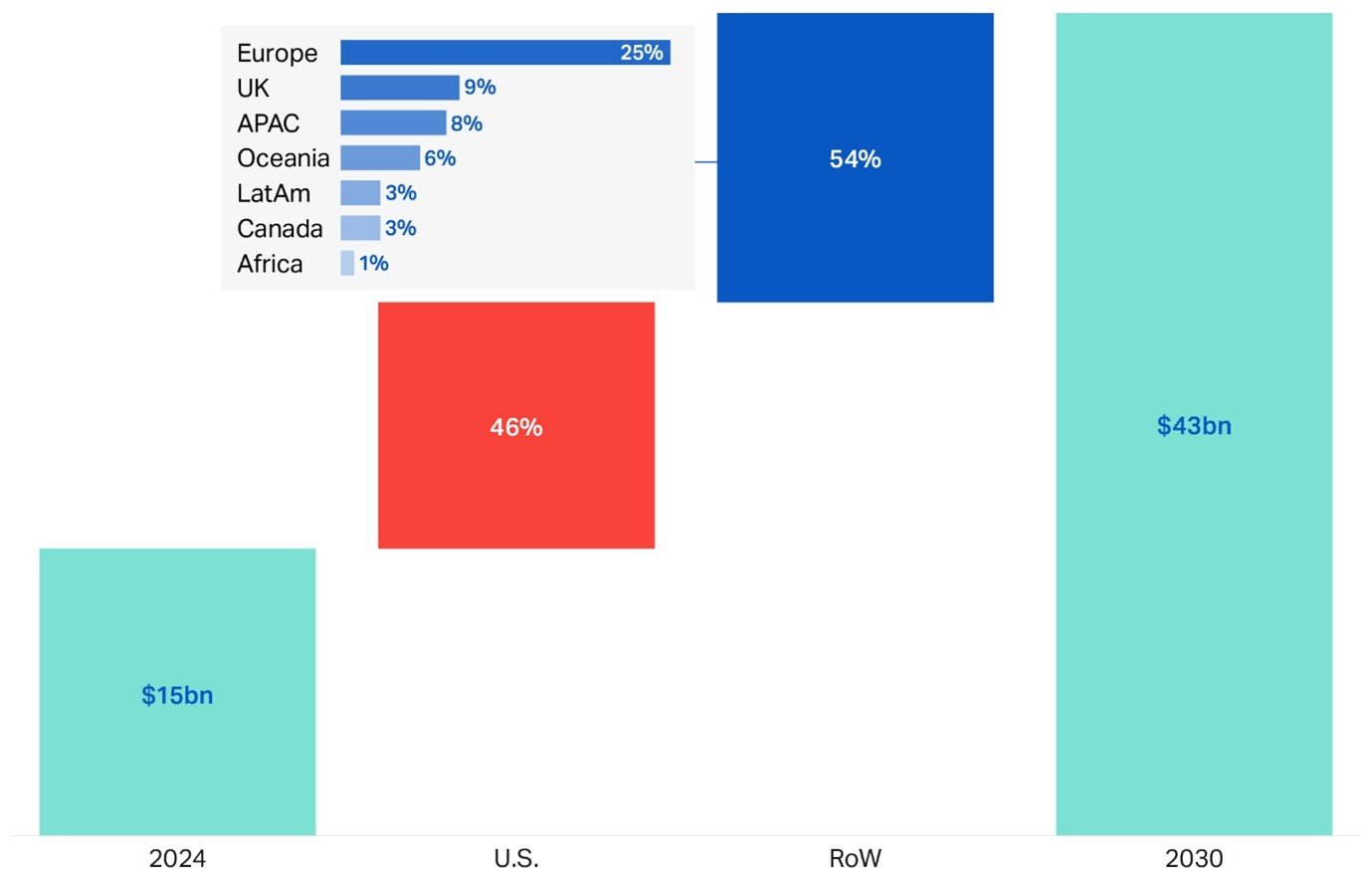

Carriers and brokers have made significant progress in the past few years of enhancing price stability, coverage clarity and the consistency of terms and conditions. Against this backdrop, the market now has two stand out opportunities to achieve Howden’s global premium projection of USD 43 billion by 2030: significant expansion beyond the U.S. and serving a broader client base amongst SMEs.

Cyber insurance has been dominated by the U.S. to date, accounting for approximately two-thirds of the global market, and sustained growth here will remain crucial. In a notable shift, however, our research also shows that more than half of premium growth up to 2030 is likely to emanate from non-U.S. territories (see Figure 2). In the major European economies of Germany, France, Italy and Spain alone, the premium uplift potential in just replicating penetration levels achieved in more mature markets is in the region of EUR 700 million.

Figure 2: Share of global cyber premiums growth by region – 2024 to 2030 (Source: Howden)

Jean Bayon de La Tour, Head of Cyber, International, commented: “Cyber insurance is key to strengthening resilience around the world and insurers are now in a strong position to bring about real change. This involves providing more capacity to meet pent up demand in currently underpenetrated regions, including Europe, Latin America and Asia, areas where Howden is investing strongly. The potential for growth is huge, particularly as most of these countries are coming off such a low base.”

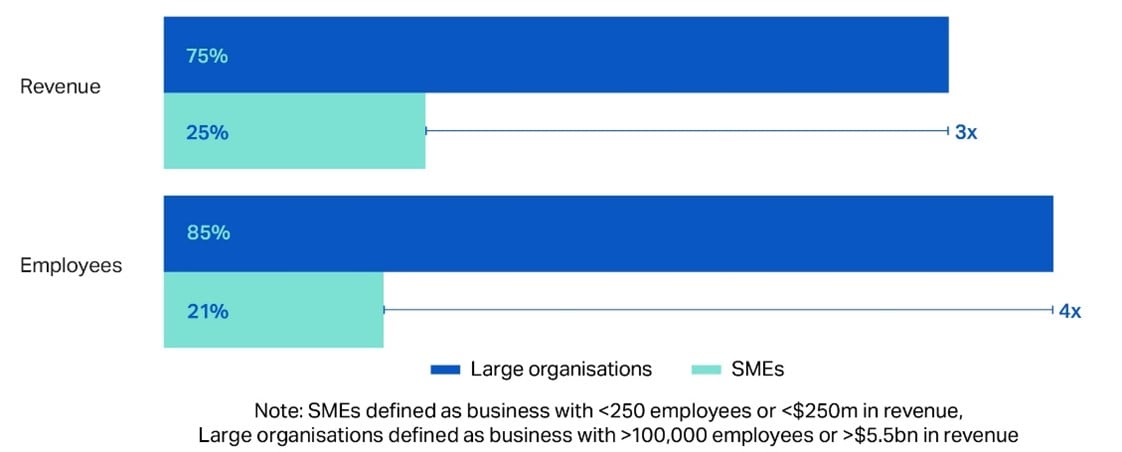

The SME space, which accounts for close to half of GDP in advanced economies, also offers huge opportunity as brokers and insurers find better ways to bring this currently underserved demographic into the cyber market. Research from the World Economic Forum in Figure 3 lays bare the opportunity in this space.

Figure 3: Share of organisations with cyber insurance globally in 2023 (Source: World Economic Forum)

Shay Simkin, Global Head of Cyber, Howden, said: “The full potential of cyber insurance can be unlocked by improving access to areas currently underserved by the market. Howden is spearheading these efforts by applying differentiated insights and expertise to deliver pioneering solutions. Alongside major investment across our cyber operations, we have launched a platform that enables SMEs to buy up to USD 6 million of cyber cover in four simple steps, with just name, industry, revenue and website required to produce a quote. Innovation is key to growth, requiring a new approach to broking that is cycle-savvy, innovative, entrepreneurial, global and home to the sector’s strongest talent.”

Risk & resilience

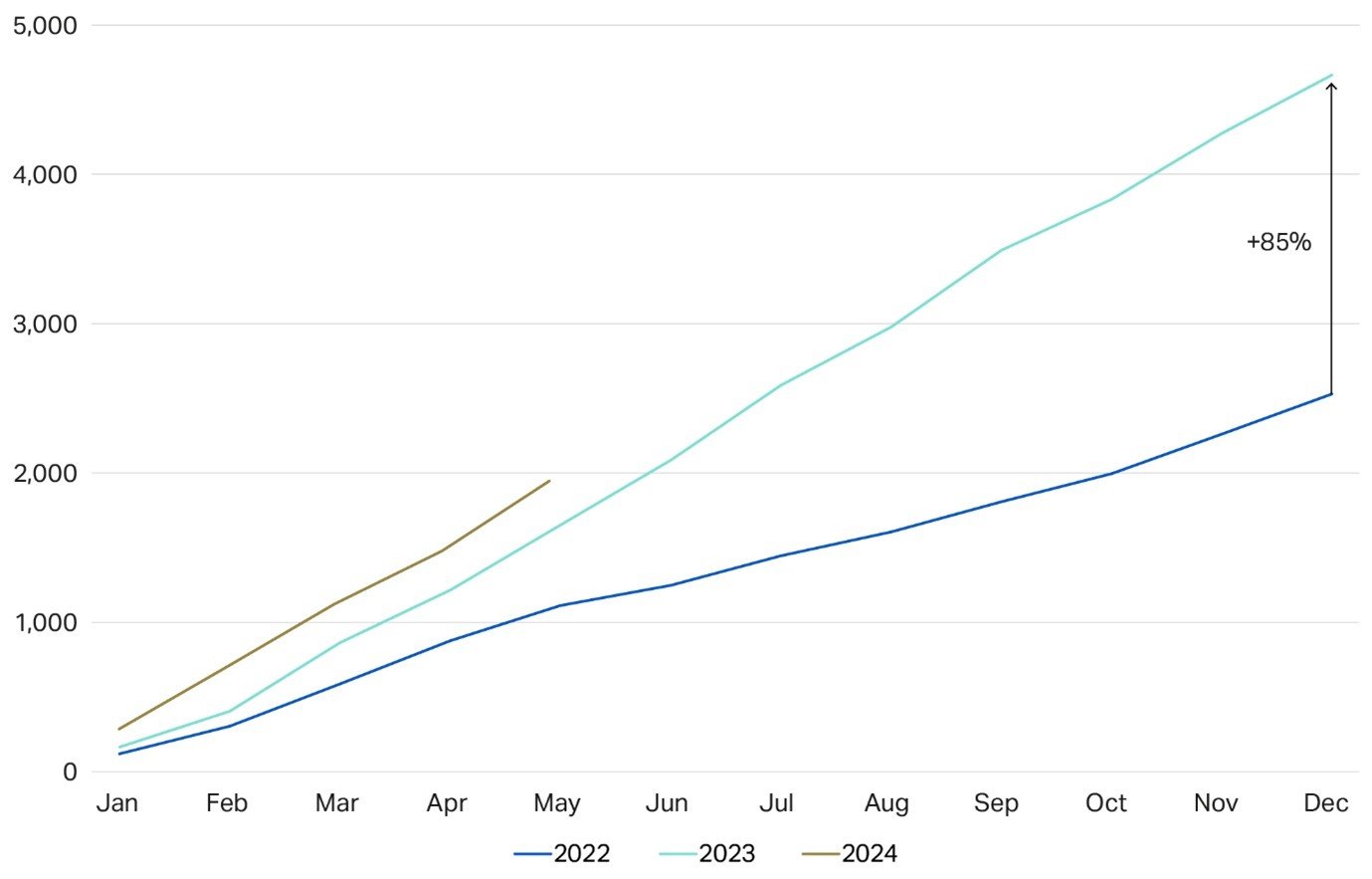

Strengthened cyber resilience is paying dividends for policyholders now ransomware attacks are reverting to the long run upward trend. Frequency is up 18% so far this year on already elevated 2023 levels (see Figure 4). Data nevertheless presents a more nuanced picture on the severity front, with recovery costs once again increasing after a temporary decline in 2022 but fewer companies being forced to pay a ransom, due in large part to more effective risk controls.

Figure 4: Cumulative global ransomware activity by month – 2022 to 2Q24(Source: Howden analysis based on data from NCC Group)

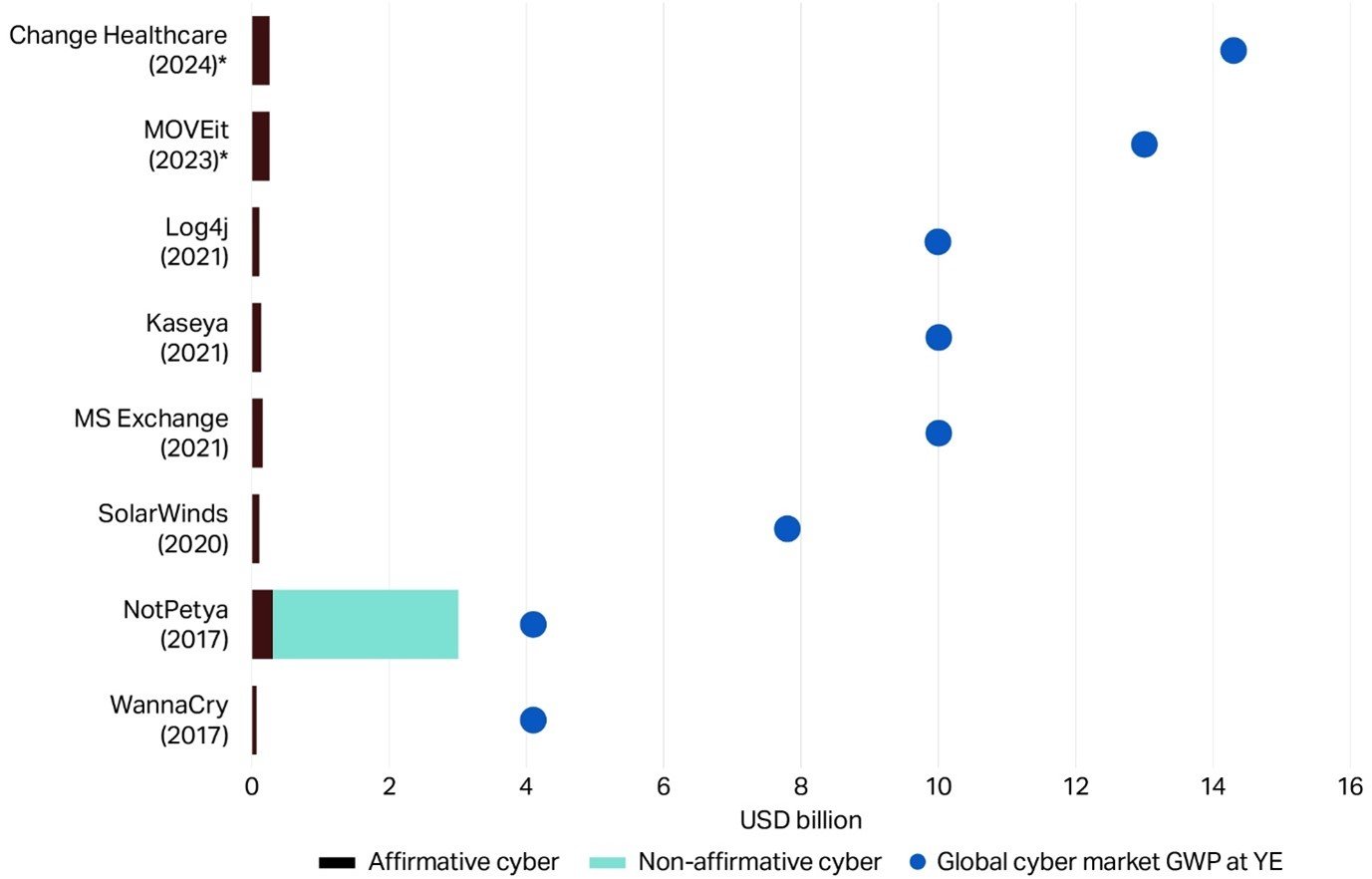

Concern about systemic risk continues to hang over the market, and recent events underscore the inherent risk of aggregation across multiple organisations via a single point of failure. As more information comes to light following a series of attacks in recent years, data shows that indirect claims from third parties have been lower on average relative to direct claims, meaning the scale of the event (or frequency of loss) would need to be multiples of what has been experienced to date to generate losses that threaten the premium base of the global market.

Figure 5: Insured loss estimates for high-profile cyber events vs GWP for global cyber market – 2017 to 1H24 (Source: Howden, PCS)

* Note: loss development for Change Healthcare and MOVEit is unknown at this stage, but market estimates indicate a loss in excess of USD 250 million for each.

Prospects for cyber insurance are strong, supported by a growing and increasingly diverse capital base. Sustinaing capital inflows will be crucial as the market moves beyond existing premium pools to meet the growing demands of businesses worldwide. By bringing important market trends to the fore, Howden is leading the discussion, enabling us to facilitate the most innovative client solutions and secure unrivalled access to capital providers.