The risk landscape is intensifying. These three graphs show the industry a way forward

Published

Read time

- Against a backdrop of rising risk, rates are falling and supply levels are healthy

- Finding new risk transfer solutions to sustain growth and close protection gaps is vital

- Howden data across climate, geopolitics and cyber data reveals vital coverage opportunities

The first half of the 2020s will be forever synonymous with global turbulence.

As we enter the second half of the decade, new Howden data points to where the global (re)insurance industry needs to focus – and the way ahead amid a shifting and deteriorating risk landscape.

From plugging protection gaps in climate to improving cyber resilience, these three graphs tell a compelling story about how the industry can better serve clients and flourish even in these uncertain times.

Read the key takeaways and download the full report

A big hole in climate protection

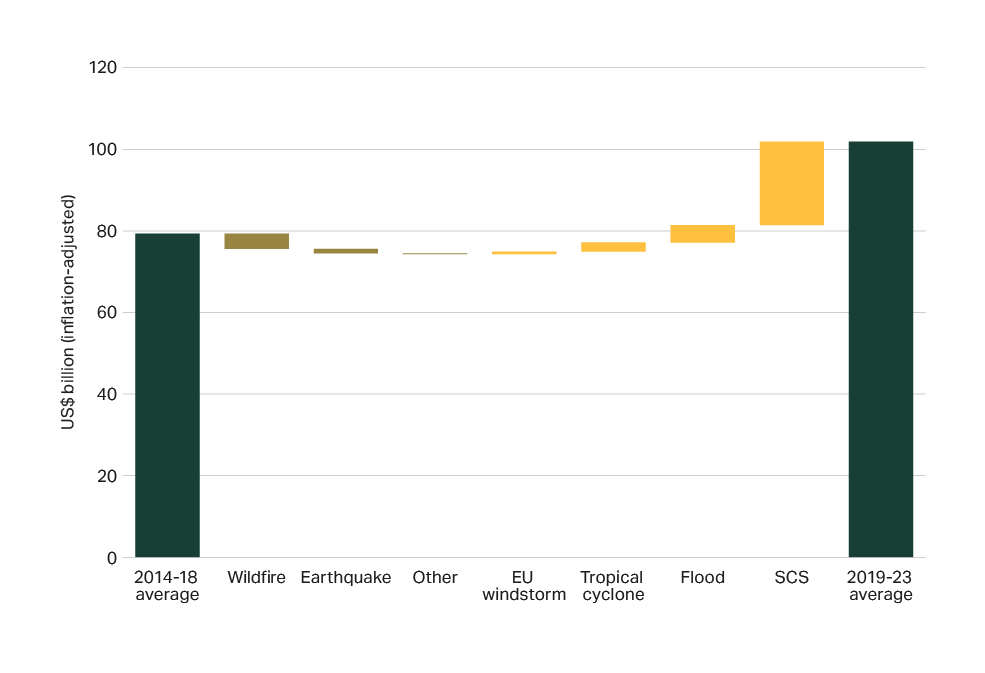

Fig. 1: Insured natural catastrophe losses since 2014 broken down by peril contribution (Source, Howden, NOVA)

Extreme weather events are becoming more severe, frequent and costly. With the loss burden falling disproportionately on the primary market.

Now is the time for reinsurers to collaborate more closely with insurers, capital providers and brokers to help fill protection gaps and develop new solutions.

Severe convective storms or SCS stand out as an urgent priority, according to Howden data. They account for ~90 per cent of the increase in insured natural catastrophe losses in recent years.

But they are often retained by insurers in full – limiting the scope for them to protect end-clients.

Rethinking modern political unrest

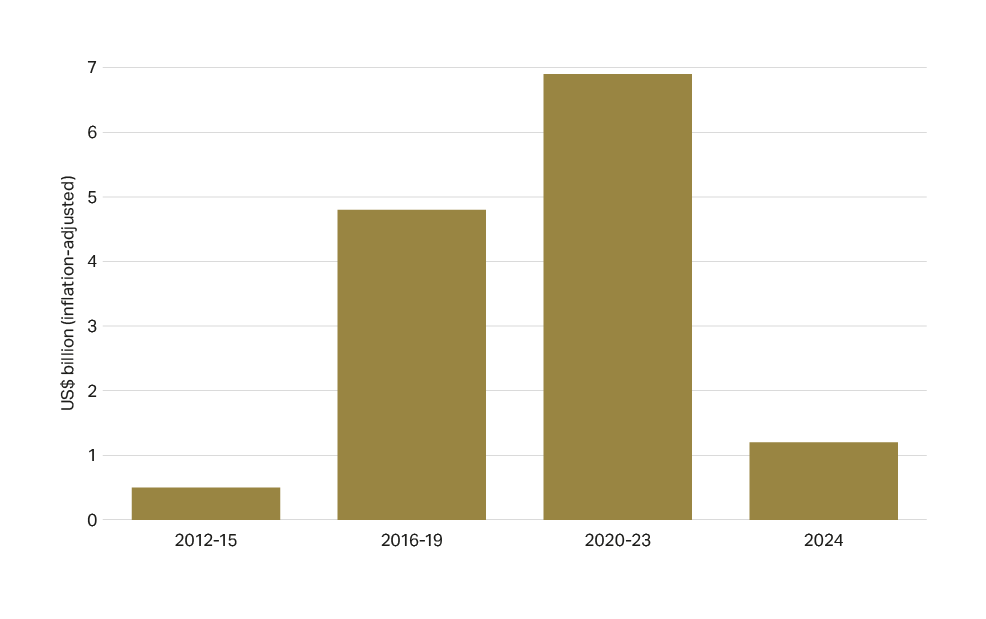

Fig. 2: Insured losses from civil unrest by four-year period from 2012 (Source: Howden)

Civil unrest is on the rise, fomented by economic malaise, political polarisation and unravelling social cohesion. The spread of mis/disinformation online is also aggravating grievances.

Against this backdrop, insured civil unrest losses have increased to $6.9 billion in 2020-23, up a staggering 13-fold from 2012-15.

Given a sizeable portion of these losses have been shouldered by property insurers – including those in Hong Kong, Chile, South Africa, France, as well as in the US due to the BLM protests – an increasing number of carriers within that market are now reassessing their exposures.

For the standalone market to fill the void, work needs to be done around aggregations and reinsurance recoveries. Rethinking event definitions to reflect the often protracted and dispersed nature of modern civil unrest is key.

Expanding cyber protections

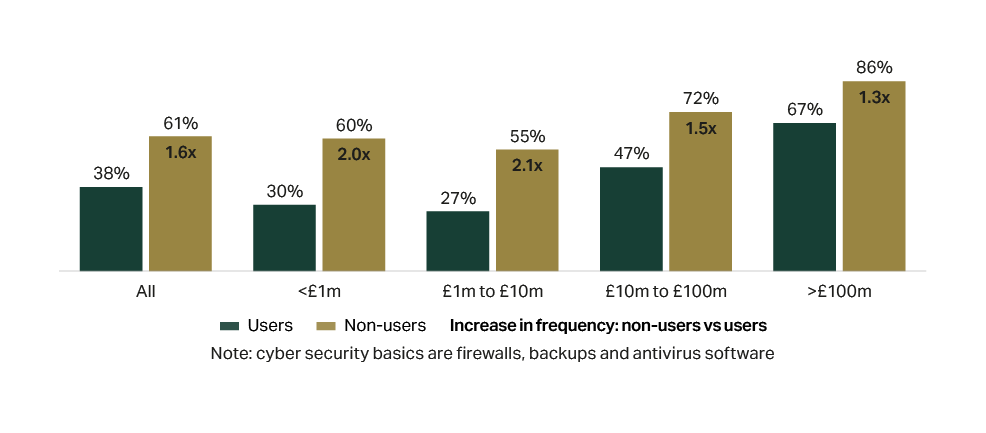

Fig. 3: Proportion of UK businesses to have suffered a cyber-attack by revenue band and users vs. non-users of cyber security basics – 2019 to 2024 (Source: YouGov, Howden)

Cyber attacks and systemic events are becoming more prevalent and destructive, fuelled by geopolitical tensions, technological advance and widespread IT vulnerabilities.

Potentially lucrative rewards for hackers also mean that they are always looking to develop and deploy new malware.

It’s little surprise then that cyber consistently ranks at the top of businesses’ risk registers.

The insurance industry has a pivotal role to play in improving cyber resilience by indemnifying losses, providing incident response services and requiring security as a prerequisite for cover.

Encouragingly, new Howden data reveals that even basic cyber security is highly effective: it reduced frequency of attacks on UK businesses by 1.6 times from 2019 to 2024.

The industry must therefore continue to expand coverage into under protected segments, such as SME businesses and continental Europe.

Finding new ways to sustain growth

Set against the market context of falling rates and healthy supply levels, finding new risk transfer solutions to sustain growth, close protection gaps and remain relevant is crucial.

Addressing extreme weather, geopolitical instability and cyber attacks should be top of mind for carriers in 2025.

Howden is leading the charge on all three fronts.